When it comes to personal finance, understanding the difference between APR and interest rates is crucial. Both terms are often used interchangeably, yet they represent important aspects of borrowing that can significantly impact the overall cost of a loan. By grasping these concepts, borrowers can make informed decisions about loans, mortgages, and credit options. In this article, we will break down the definitions of APR and interest rates, explore their roles in lending, and discuss how they differ, especially in relation to types of loans and credit products.

Interest rates are the cost of borrowing money, typically expressed as a percentage of the total loan amount. The rate can be fixed, meaning it remains the same throughout the life of the loan, or variable, meaning it can fluctuate over time based on market conditions. On the other hand, APR, or Annual Percentage Rate, encompasses not just the interest rate but also any additional fees or costs associated with taking out a loan. Understanding these distinctions can help borrowers choose better loan products that suit their needs.

APR vs. Interest Rate

While the terms APR and interest rate are often confused, they refer to different things in the world of borrowing. The interest rate is a straightforward percentage that reflects the cost of borrowing the principal amount. In contrast, the APR is a broader measure that includes not only the interest rate but also other fees and costs incurred during the borrowing process, expressed as a yearly rate. Understanding the distinction is key to understanding your total loan expense.

For example, if you take out a loan with an interest rate of 5%, and there are additional fees totaling 2% of the loan amount, your APR would be higher than the 5% interest rate. This difference means that two loans with the same interest rate could have different costs based on their APR, which highlights the importance of looking beyond the interest rate alone.

- APR accounts for the interest rate, loan fees, and additional costs.

- Interest rate indicates only the borrowing cost without additional fees or costs.

- Understanding both can help in calculating the total cost of borrowing.

In practice, knowing both the APR and the interest rate helps borrowers make more discerning choices, leading to potential savings.

What Is the Interest Rate?

The interest rate is the percentage charged on the total amount of borrowed money, or on the total amount earned through an investment over a particular period. It serves as the cost of borrowing funds and is typically expressed as an annual percentage. For borrowers, the interest rate directly influences monthly repayment amounts and overall costs of loans.

When borrowing funds, a lower interest rate equates to lower monthly payments and reduced total interest paid over the duration of the loan. Variations can occur from several factors, including credit score, loan type, and economic conditions.

What Is APR?

APR stands for Annual Percentage Rate, and it represents the total cost of borrowing money, expressed as a yearly interest rate. Unlike the interest rate, APR includes not only the interest on the loan but also any additional fees or costs associated with taking out the loan. This comprehensive measure provides borrowers with a more accurate picture of what their loan will actually cost over time.

- APR includes loan interest rates, origination fees, and closing costs.

- Provides a more complete view of borrowing costs than the interest rate alone.

- Helpful for comparing various loan products effectively.

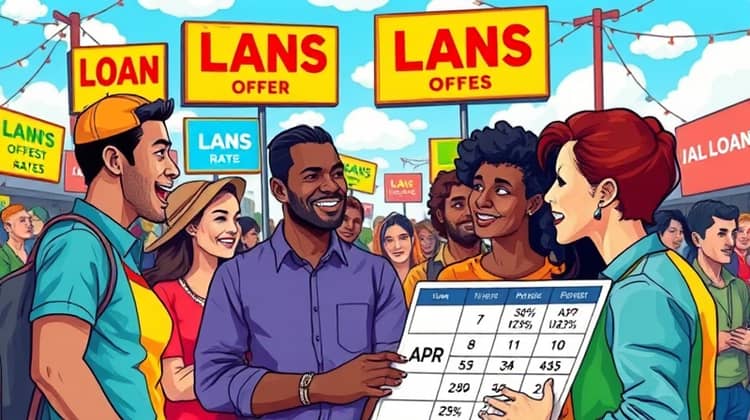

As a result, when assessing loans, it is beneficial to compare APRs in addition to interest rates to gain a clearer understanding of the true cost of each loan option.

Why APR Is Used

APR is used by lenders to provide a more accurate representation of the total cost associated with a loan. When borrowers are shopping for loans, APR enables them to compare multiple loan offers easily, despite differences in terms and conditions. By focusing on APR, borrowers can avoid surprises and make informed decisions regarding which loan product is most financially feasible.

Fixed vs. Variable Interest Rates

When exploring loans, understanding the differences between fixed and variable interest rates is essential. Fixed interest rates remain constant throughout the life of the loan, allowing borrowers to have predictable monthly payments. This can be advantageous in managing a budget, especially if rates are low and locked in for the duration of the loan.

In contrast, variable interest rates fluctuate based on market conditions. While variable rates can start low, they can increase over time, leading to higher payments and added uncertainty for borrowers. Individuals should weigh their risk tolerance when deciding which type of rate works best for them.

- Fixed rates provide consistent payment amounts through the life of the loan.

- Variable rates can lead to fluctuating payments depending on market conditions.

- Borrowers should consider their financial situations before choosing between them.

Ultimately, the choice between fixed and variable rates will depend on individual financial situations and the risk comfort level of the borrower.

Fixed-Rate Interest

Fixed-rate interest loans offer the stability of constant payments throughout the loan term. This predictability allows borrowers to budget effectively and plan for their financial future without worrying about fluctuating rates. Usually, fixed rates are slightly higher than introductory variable rates, but they can be advantageous in times of rising interest rates.

Many borrowers prefer fixed-rate loans for mortgages, car loans, and personal loans, as the peace of mind knowing that monthly payments will never increase provides a sense of security. Therefore, when interest rates are low, locking in a fixed-rate loan can result in substantial long-term savings, especially for major purchases.

In contrast to variable interest rates, fixed rates remain unaffected by changes in market conditions. Borrowers can focus on meeting their obligations without the anxiety that their payments will increase unexpectedly due to economic changes.

Variable Rate Interest

Variable rate interest means that the interest rate on a loan can change over time. This means that while a borrower might initially enjoy a lower rate compared to a fixed-rate option, their monthly repayments could increase if the market interest rates rise. Such uncertainty can be both a blessing and a curse, depending on the trajectory of interest rates over time.

Variable rates are more commonly found in credit cards and home equity lines of credit. They can provide possibilities for lower payments during favorable market conditions. However, borrowers must be cautious and maintain a financial buffer for potential rises in repayment amounts, keeping overall budgeting strategies in mind.

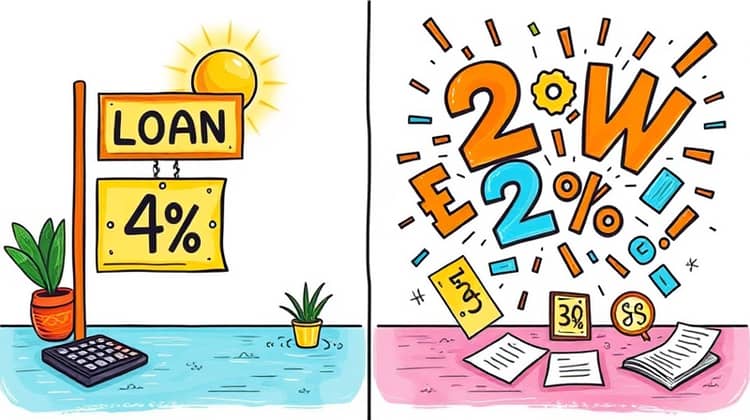

APR vs. Interest Rate: Example

To illustrate the difference between APR and interest rates, consider two loans: Loan A has an interest rate of 4% with minimal fees, while Loan B has an interest rate of 4% but significant fees that add up to 2% of the loan amount. Therefore, even though both loans carry the same interest percentage, their APR differs. Loan A would have an APR closer to 4%, whereas Loan B might have an APR of 6%. This difference means that Loan B is more expensive in the long run, despite having the same nominal interest rate.

As borrowers evaluate their options, calculating the total cost involved with each loan using the APR metric can lead to a clearer understanding of their financial decisions. In this case, while Loan A may seem attractive because of its lower APR, it also may have restrictions or penalties that need to be considered. Hence, borrowers must look beyond just the rates. They should also investigate terms, conditions, and potential penalties to ensure they make the most informed decision possible.

In summary, comparing APRs is vital as it provides clarity about the total amount that borrowers will pay over the loan's entire term. An APR that is too high can negate the initial appeal of a low-interest rate; this is especially important in scenarios involving large sums of money, such as mortgages or long-term loans. As a general rule, always favor lower APRs when selecting loans or credit facilities.

Ultimately, the clearer understanding of APR versus interest rate can empower borrowers to make sound financial choices that potentially save money over the loan's lifespan, leading to healthier financial futures.

Why APR Doesn’t Matter in a Mortgage

When it comes to mortgages, APR can sometimes be misleading. While a lower APR may seem appealing, it’s crucial to consider other factors like the loan term, closing costs, and points that may impact the overall cost. Often, some lenders may advertise low APRs but may impose high closing costs or other fees that accumulate over time, resulting in higher expenses than apparent.

It means that for mortgages, borrowers should not only emphasize the APR but also calculate the total principal and interest paid over the life of the loan to ascertain the real financial commitment involved. Doing so will contribute to more prudent financial planning and potentially avoiding hidden costs often overlooked when focusing solely on APR.

Credit Cards

Credit cards typically utilize variable interest rates, which can make managing finances more complex. Their APR can change depending on the credit card issuer's policies, and market shifts also influence them. As a result, individuals can find their monthly payments increasing, especially if they carry a balance from month to month.

Additionally, credit card APRs often have different rates for purchases, cash advances, and balance transfers, which necessitate understanding each associated cost. Due to the ease with which debt can accumulate on credit cards, being fully informed about the implications of APR is vital to maintaining a solid financial footing. Consequently, individuals should assess their spending habits, repayment plans, and choose cards with lower APRs to better manage their finances.

Interest Rate vs. APR: Which Matters More

Determining whether the interest rate or the APR matters more depends on the context of the financial product in consideration. For short-term loans or situations where borrowers pay off a loan quickly, the interest rate might be the primary focus since lower rates lead to less interest paid overall. However, for longer-term loans, such as mortgages or significant loans with various fees involved, APR gives a better understanding of the total cost, as it incorporates those additional expenses.

Ultimately, borrowers must evaluate their specific needs, timelines, and how long they intend to hold onto debt to ascertain which measure should take precedence in their decision-making processes.