Predatory lending refers to unfair, deceptive and fraudulent practices of some lenders during the loan origination process. It often occurs when borrowers are not fully aware of the terms involved or when they cannot afford the loan that they are being offered. In this blog, we will delve into various aspects of predatory lending, highlighting what to watch for to avoid falling victim to these unscrupulous practices.

Understanding common tactics used by predatory lenders can empower you to protect yourself and make informed financial decisions. Let’s explore several warning signs associated with predatory lending, and learn how to safeguard your financial future.

1. Understand Predatory Lending

Predatory lending has become increasingly widespread, especially in economically vulnerable communities. Many individuals lack the knowledge and resources to recognize when lenders are exploiting them through unfair practices. To effectively address this issue, it is vital to educate ourselves about the fundamentals of predatory lending, its impacts, and how it operates.

Predatory lenders often target individuals with poor credit histories or those in desperate financial situations. These lenders prey on the unsuspecting borrower’s predicament, trapping them in loans that are structured to be difficult to pay off, thus leading to a cycle of debt.

- Lending practices that are not transparent

- Use of high-pressure sales tactics

- Lack of proper disclosures about loan terms

Understanding these characteristics can help borrowers identify misleading loan offers and pursue alternative financing options that are more responsible and affordable.

2. High-Interest Rates and Excessive Fees

One of the most conspicuous signs of predatory lending is the imposition of sky-high interest rates. These rates can often be several percentage points higher than the average prevailing rates, putting borrowers in a precarious position where repayment becomes challenging or impossible.

In addition to high-interest rates, predatory lenders frequently tack on excessive fees. These might include origination fees, processing fees, and late payment penalties that are disproportionately high, effectively making the loan cost prohibitive and trapping borrowers in worse financial situations.

As a result, borrowers may find themselves constantly paying fees rather than making any real progress on paying down the principal balance of the loan, leading to a downward spiral of debt.

3. Loan Flipping

Loan flipping refers to the practice where a borrower is encouraged or coerced to refinance an existing loan into a new one that is not necessarily beneficial for them. This is often accompanied by new fees and higher interest rates than the original loan.

Lenders who engage in loan flipping may present it as a way for borrowers to lower their monthly payments or improve their financial situation, yet often it leads to the opposite effect.

As the borrower continually flips loans, they may end up submerging themselves deeper into debt while the lender accumulates hefty fees and interest.

4. Packing and Yield Spread Premiums

Packing occurs when lenders include unwanted or unnecessary products, like insurance policies or add-on services, into the loan package, often without the borrower’s informed consent. This practice is unethical as it inflates the cost of the loan without providing any real value to the borrower.

Yield spread premiums are incentives given to brokers for steering borrowers towards higher interest loans than they may qualify for. This practice creates a conflict of interest since it encourages lenders to pursue their own financial gain rather than the best interest of their clients.

Both packing and yield spread premiums contribute to the overall cost of borrowing, often exceeding what borrowers expect or can afford.

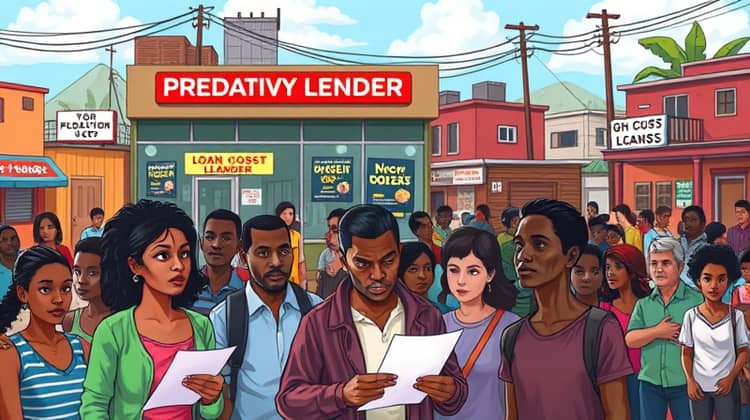

5. Targeting Vulnerable Populations

Predatory lenders often focus on communities that are economically disadvantaged or lack access to traditional banking services. These populations are frequently misled into believing they are receiving loans that provide them with opportunities, when in reality, they are entrapped in high-cost debt.

Lenders may exploit borrowers’ lack of financial literacy and take advantage of their urgent need for funds, presenting high-cost loans as their only option during financial distress. By doing so, they create an imbalance in power where borrowers feel compelled to take loans even when they are not in their best interest.

6. Unscrupulous Collection Practices

Many predatory lenders engage in harsh collection practices that go beyond the law. These may include frequent phone calls, threats, and aggressive tactics designed to intimidate borrowers into making payments, regardless of their financial ability to do so.

Aggressive collection tactics can leave borrowers feeling overwhelmed and helpless, often leading them to make decisions that are not in their best financial interest, such as withdrawing funds from retirement accounts or taking out additional loans to cover existing debts. They can also lead to significant emotional and psychological stress for the borrower.

It’s essential to recognize that ethical lenders should operate within the confines of the law while being respectful and understanding of a borrower’s situation.

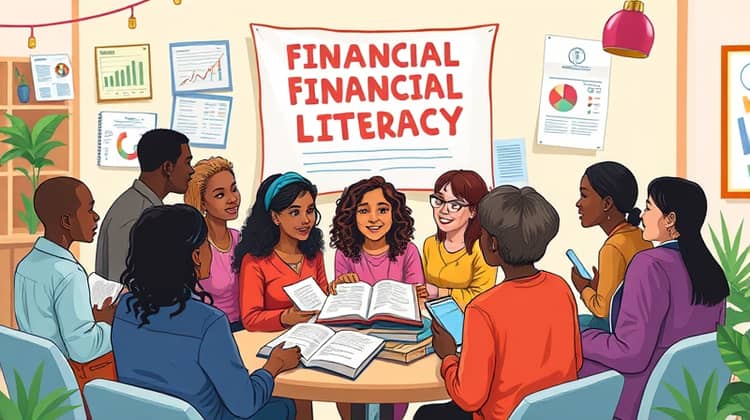

7. How to Protect Yourself

To protect yourself from predatory lenders, the first step is to educate yourself about your rights as a borrower and understand the types of lending products available to you. This knowledge serves as your greatest defense against manipulation by unscrupulous lenders.

Next, always compare multiple offers from reputable lenders before making a decision. This not only helps you understand what reasonable rates and fees look like but also allows you to hold lenders accountable if they offer terms that are too good to be true.

Additionally, be wary of offers that seem too appealing, and do your due diligence by researching any lender you consider working with.

- Research potential lenders thoroughly

- Request free copies of your credit report

- Avoid signing anything without reading the fine print

By being vigilant, you can make more informed decisions and safeguard your assets from being taken advantage of by predatory lenders.

8. Seek Help and Report Predatory Lending

If you find that you’ve fallen victim to predatory lending, it is crucial to seek help immediately. Depending on your situation, you might want to consult a financial advisor or a legal expert who specializes in consumer rights and predatory lending practices.

Additionally, reporting suspected predatory lending practices to the appropriate regulatory bodies or consumer protection agencies can make a considerable difference. Taking these actions not only helps you but also assists in combating predatory practices at a broader level by holding irresponsible lenders accountable.

Knowing where to turn for help can mean the difference between sinking into a cycle of debt or regaining temporary control over your finances.

Conclusion

Predatory lending practices take many forms, and being aware of them is the first step toward safeguarding yourself from potentially devastating financial situations. By educating yourself and being proactive, you can avoid falling victim to these unfair practices.

Ultimately, the more informed you are, the better positioned you will be to avoid predatory lending and protect your financial health. Always remember, when in doubt, seek professional advice and prioritize your financial security.